does doordash do quarterly taxes

To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153. Do you pay taxes on Doordash tips.

How To File 1099 Taxes Properly Uber Doordash Lyft Etc Youtube

Another option is to pay quarterly estimated payments direct to the IRS.

. You do PAY quarterly taxes if you expect to owe more than 1000 in taxes by the end of the year. If you will owe money on taxes this year you really want to think about getting a payment sent in by tomorrow if you havent already done so. You do not FILE quarterly taxes.

Ive been driving for DoorDash since January 2020. Federal income taxes apply to Doordash tips unless their total amounts are below. Driving for Doordash and quarterly taxes.

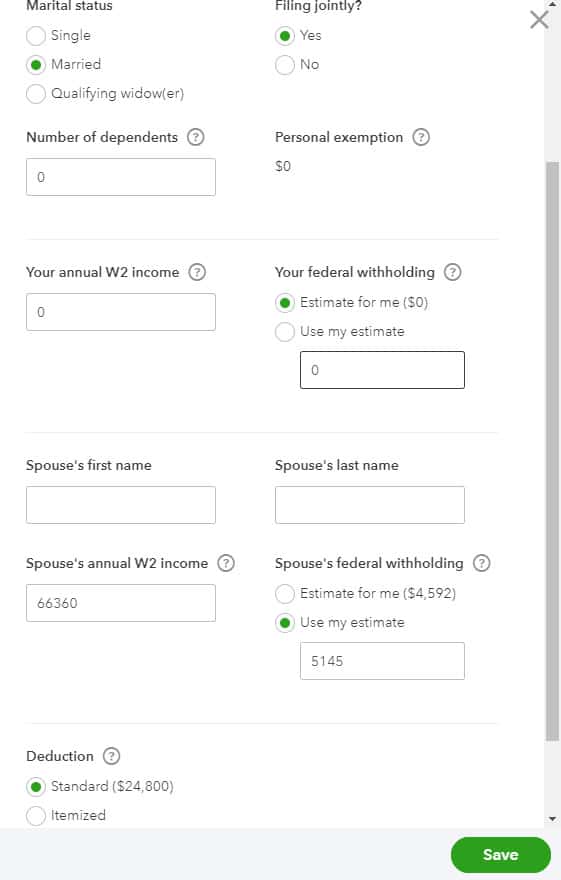

Since youre an independent contractor you might be responsible for estimated quarterly taxes. Had no other expenses of being a DoorDash driver other than your auto mileage then this is your 2020 federal income. Do you owe quarterly taxes.

Since DoorDash earnings are treated essentially the same. Drove a total of 500 miles in 2020 to make your DoorDash deliveries and. There isnt a quarterly tax for 1099 Doordash couriers.

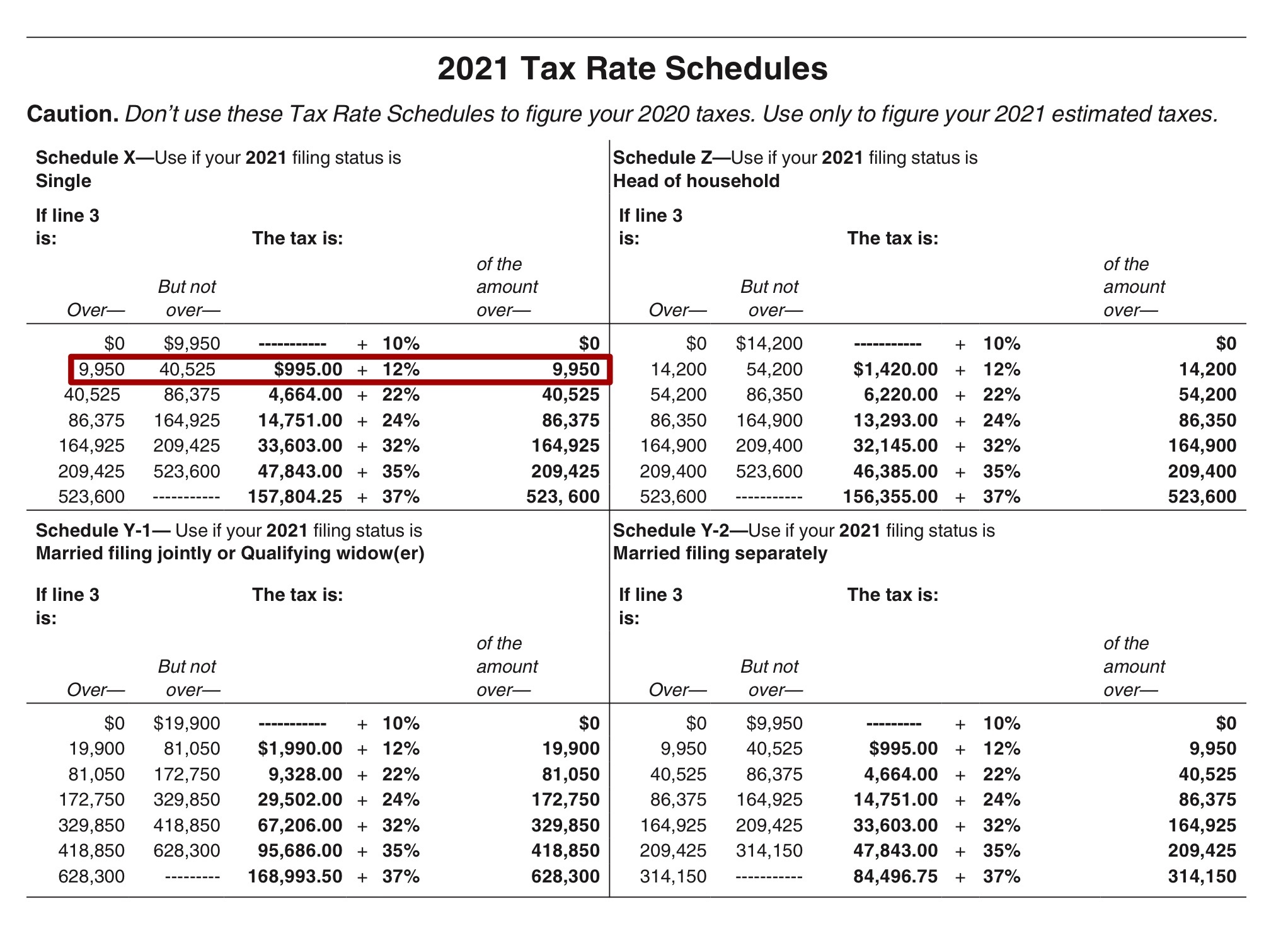

There are four major steps to figuring out your income taxes. Do you have to pay quarterly taxes for DoorDash. Do I have to pay quarterly taxes for DoorDash.

Yes - Cash and non-cash tips are both taxed by the IRS. A 1099-NEC form summarizes Dashers earnings as independent. Do you owe quarterly taxes.

Since youre an independent contractor you might be responsible for estimated quarterly taxes. Calculate your income tax. You only file your taxes once a year like anyone else.

Internal Revenue Service IRS and if required state tax departments. However you may now be wondering what the process is for filing DoorDash taxes in 2022 to ensure you cover any tax liability. The forms are filed with the US.

Add up all of your income from all sources. Those who use the app and make deliveries are considered independent contractors and it. Reduce income by applying deductions.

No state or federal taxes are removed from payments from DoorDash to drivers and as independent contractors drivers are responsible for paying these taxes each year. Federal income and self-employment taxes are annual. We file those on or before April 15 or later if the government.

Do I have to. If you made 5000 in Q1 you should send in a Q1. This could help you avoid a surprise tax bill and possibly keep you from paying any penalties.

Do Doordash Contractors Pay Quarterly Taxes Entrecourier

/images/2019/12/11/essential_guide_to_quarterly_taxes.jpg)

The Essential Guide To Quarterly Taxes 2022 Financebuzz

Tips For Filing Doordash Taxes Silver Tax Group

The Best Guide To Paying Quarterly Taxes Everlance

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

Guide To 1099 Tax Forms For Doordash Dashers Stripe Help Support

Doordash Taxes And Doordash 1099 H R Block

Estimated Taxes For Uber Instacart And Other On Demand Companies

How Do I File Estimated Quarterly Taxes Stride Health

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

Ultimate Tax Guide For Doordash Lyft And Uber Drivers For 2022 Youtube

.png)

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Prepare For Tax Season With These Restaurant Tax Tips

4 Ways To Maximize Your Earnings On Doordash R Doordash

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

My Door Dash Spreadsheet Finance Throttle

How Do Food Delivery Couriers Pay Taxes Get It Back